Case study: The Journey of Paytm

With this piece, we’ll try to understand the case study of Paytm, which will explain how the brand went from being a mere recharge app back in 2010, to hosting everything as of today. This case study also explains the current difficulties of Paytm given the increasing competition and the loss of interest of the investors.

Started by Vijay Shekhar Sharma, as a Recharge platform in 2010, Paytm (One 97 Communications Ltd) became the most successful mobile payment and money transfer app used in India a few years back. For a country which had 95% of monetary transactions made in cash prior to demonetization, it was difficult for Paytm to make customers believe in digital money. But, Paytm did the drill, they tapped the un-served/under-served lots of India and enabled them to do cashless transactions. And, by the means of cashbacks and offers, Paytm raced ahead of its then rivals – Freecharge, PayU, Mobikwik, etc.

However, the picture seems to be changing today. After the entry of players like Google Pay & PhonePe, the brand is starting to fall behind in the race. And given the poised release of WhatsApp Pay somewhere this month (June, 2020), things are only going to be tougher for the company. Let us understand the journey of Paytm to essentially understand their position today.

Business Aspects and Expansion:

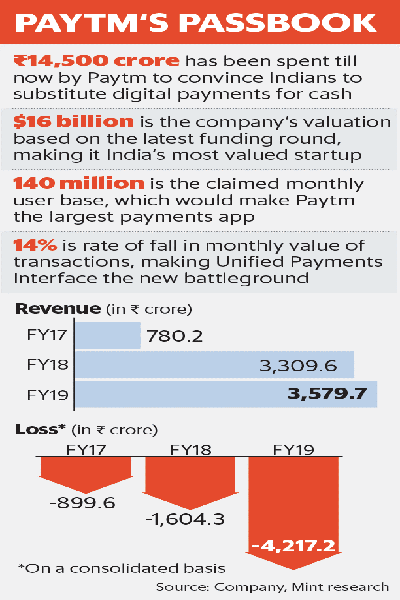

Paytm has always focused on the customer-centric approach. This is evident from that fact that, even before Paytm started with wallet services, the company built a 24×7 customer care service. It understood that digital payments were still new in India and so, it had to ensure their customers get all the right support. This enabled people to get their queries solved and trust their money with Paytm. It has spent nearly Rs.14,500 crore to convince Indians to substitute cash with digital payments. One can clearly understand how Paytm must have pivotal role in our Hon. Prime Ministers’ Digital India dream.

In 2014, the company did one of their major launches – that is the Paytm Wallet. This enabled the users to directly pay without entering an OTP again and again. Which was again new for the customers, given they thought using OTP kept their money safe. Now, one might think this to be the wrong move. However, this was one of the features that gave Paytm the best results. When a user kept its money in the Paytm wallet, they were not charged. However, Paytm kept the money with Escrow accounts which fetched Paytm interests.

Demonetization – An opportunity for Paytm:

Anyway. Let’s continue, and understand when the future actually started to look fortunate for Paytm. We’d all remember Demonetization, don’t we? Ah, those long ATM hours, lots of money with not value. Those were the days.

While demonetization spelled doom for most of us, it was actually a fortune for Paytm, and we don’t need to tell you why. Or do we? Okay. So, our Hon. Prime Minister had a vision to turn the economy digital. Digital could help the Government track the money and essentially reduce the influx of black money in the economy.

Now, Paytm was the biggest digital payments app back then. And so, when the demonetization happened, it went through the roofs! It extended services to retail stores, Kiranas, Vegetable shops, Saloons, even Pan shops! It was everywhere! Paytm grabbed the biggest piece of all the online payments happening during that period.

Given the progress Paytm was making and the amount of Government support they were enjoying, it got into aggressive marketing which showcased the involvement of retail shop owners.

Anyway, that was a time to be remembered both for us and Paytm, alike.

The pain-points:

All the good stuff probably ended in the paragraph above, let us now try to understand the challenges the brand has faced in the recent past.

Paytm vs PayPal:

While Paytm was busy counting its profits after Demonetization, a US-based payments company PayPal filed a case against Paytm for using a logo similar to its own. They look pretty similar, PayPal was probably right.

PayPal accused Paytm of using the similar logo which it had been using since 2007. This would create confusion in Indian customers about the platform. The case is still in court and if Paypal wins, Paytm would have to pay heavy charges for trademark infringement.

UPI (Unified Payments Interface):

With the launch of Unified Payments Interface, two major giants – Google Pay and PhonePe entered the market and people preferred UPI transactions over Paytm wallet transactions. To keep up the race, Paytm also launched BHIM UPI transaction mode but recorded lower transactions than its rivals.

Do you know why?

FMA. The first mover advantage. Paytm probably thought that their wallets will sustain them against these players, which was nice, in theory. We all would remember, right? Google Pay actually went rogue with the middle class of the country, do you remember your friends telling you to send some cash just to gain some extra bucks in the transaction?

Little did you understand that you were actually getting used to using Google Pay, smart. Use less money in marketing and instead give that away to the customers!

Current picture:

Paytm has been losing ground to its competitors with bigger pockets. To add salt to the injury, the Jio-Facebook deal is posing enormous threat to the company. Jio has already started on-boarding local shops on their platform. Who will then essentially host motivate these owners to use Facebook’s WhatsApp Pay, poised to launch in June, 2020.

Given that WhatsApp has around 400 million users in India, integrating payment here would make it convenient for the users to just send money. And, essentially, inconvenient for Paytm. This has raised concerns amongst investors about Paytm’s total valuation and business model. With the losses mounting up, it would be difficult for Paytm to keep its head above the water and continue the trust of its investors.

Classic example of why you must choose your niche. If you have ever used Paytm, you will realize that the company actually tried to expand into a lot of spaces. It tried to have movie bookings, travel, bill payments, shopping deals, banking and finance (Paytm banks) and what not! Maintaining so much requires equal amount of capital, and having concerned investors on board will not make that happen for you.

Anyway, that’s it for this piece. This brilliant piece was penned down by Geeta Belani, go drop her a thank. Share this piece with your best friend, and share your thoughts as to what Paytm can do to improve their stance as of right now?

Have a good one!

Pingback: COVID-19: Bane for the World, Boon for EdTech in India | CaseReads

Pingback: Concepts at ease: What are Neobanks? | www.casereads.com

Pingback: Neobanks In India: Understanding What Are Neobanks?

Pingback: Wirecard Scandal Explained: A Modern-day Hera Pheri

Pingback: The Resurgence Against The App Store Monopoly

Pingback: FinTech In India And The World: Evolution, Impact, And Uses

Pingback: Idea Cellular Case Study: From Idea To Vi

Pingback: The 101 Of Consumer Promotions With Examples